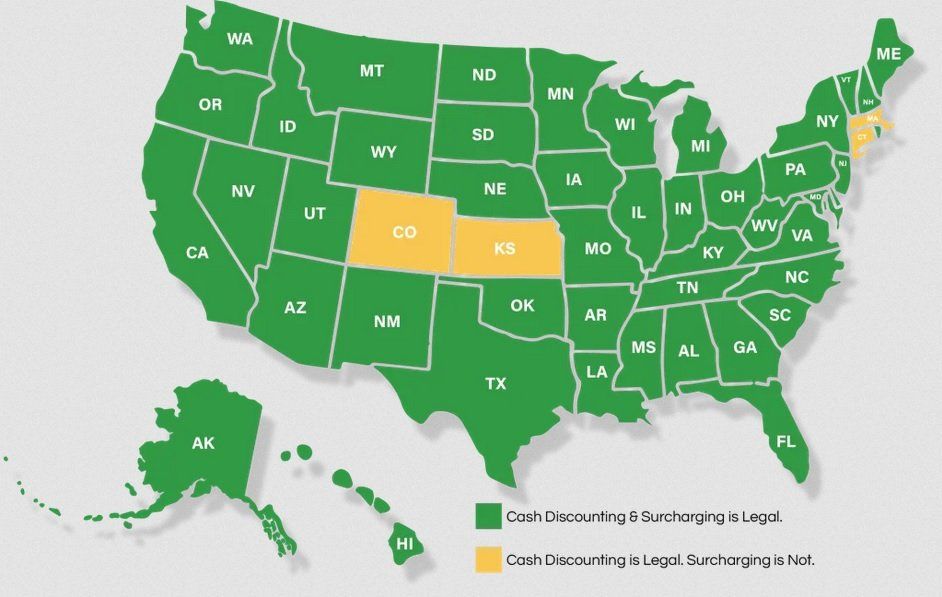

Is Cash Discounting & Surcharging Legal?

- Cash Discounting

The Payment Card Interchange Fee & Merchant Discount Antitrust Litigation as well as the passing of laws such as The Dodd Frank Wall Street Reform, The Consumer Protection Act, and The Durbin Amendment have given the power to merchants in all 50 states to implement Cash Discount programs in their brick and mortar locations as well as their online locations. Cash Discounting is now accepted nationwide.

- Surcharging

Surcharging is rapidly gaining approval throughout the United States. Originally there were a total of 10 states that banned surcharging, but now there are only 4. As of 2020, Colorado, Connecticut, Kansas, and Massachusetts are the only states that still do not allow merchants to apply surcharging fees. Previously, states such as Texas and New York banned surcharging, but the states found in favor of the merchants taking their side in the battle against credit card processing fees. In January 2019 the state of New York overturned the ban on surcharging.

How Does Cash Discounting & Surcharging Work?

Breakdown

- The merchant enters the sales amount

- The terminal automatically calculates the 3.99% Non-Cash Charge

- The customer swipes / inserts their card

- The receipt clearly breaks down sales and Non-Cash Charge in both retail and restaurant locations including tip when necessary.

- The full sales amount goes directly to the merchant. No processing fees are deducted.

- Vader Business uses the 4% Non-Cash Charge to cover interchange costs, authorization costs, transaction costs, and support.

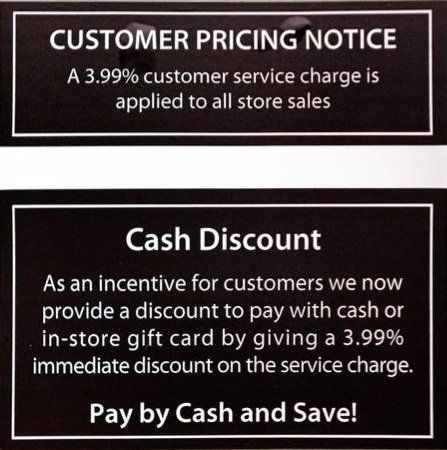

- Merchant must display signage at the following:

- Merchant’s point of entry (in-store & online)

- Point of transaction (payment location & check out page)

- Charge to customer cannot exceed 3.99% and cannot be called a “Fee”

- Non-Cash Charge must be shown:

- Separately on the front of the receipt

- In same font & size as other wording on the transaction receipt.

- Vader Business provides Signage Stickers to be placed at point of entry and register in-store and a disclaimer for online stores.

- Vader Business will never assess a charge greater than 3.99% on any credit card or debit card transaction even on sales under $10.00

- The Vader Business receipt clearly displays “Non-Cash Charge” separately and in the same size and font as other text on the receipt.

100% Compliant

Vader Business follows all card brand rules and regulations and provides the following to ensure compliance:

- Signage

- Technology

Processing Made Easy

Accepting Credit Cards is a no brainer with Vader Business:

- Remove $10 minimum signs since you never pay the processing fee

- Businesses that chose not to accept Credit Cards due to fees can now accept cards and increase sales

Equipment

All processing solutions available:

- IP, Dial, and Wireless Terminals

- EMV Bluetooth Swipers for iPhone & Android

- Virtual Terminals

- POS Systems / POS Integrations

- Online Processing / Shopping Carts

Easy Capital

- As a Vader Business merchant you have instant access to working capital that can be deposited into your bank account in as quick as 24 hours.s

- Cash Discounting is Fully Compliant with Federal and State Laws

The Durbin Amendment does not allow any payment card network to inhibit a merchant’s ability to implement a cash discount.

- The U.S. Has the Highest Interchange Rates

U.S. interchange rates are unregulated, allowing payment card networks (Visa, MasterCard, etc.) to charge what they want at any time. Interchange fees will continue to increase to the merchant.

- Raising Your Prices Loses Customers

It has been proven that raising prices costs far more customers than implementing a cash discount program.

- Offset the Rising Minimum Wage Rate

States across the U.S. are raising minimum wage rates, especially in the Tri-State area with New York at $15/hour with New Jersey soon to follow.

- Avoid Junk Fees and All Other Miscellaneous Fees

Junk fees are just one example of a junk fee charged by your traditional credit card processor.

- Removing Minimum Credit or Debit Card Signs

Cash Discounting removes the need to display a minimum debit or credit card sales signs.

- Offset Other Constantly Growing Costs of Doing Business

From rising rent to inventory costs, the cost of doing business grows every year for merchants with no relief.

Businesses that join Vader Business see an immediate increase in profit as a result of the savings from eliminating their processing bill. These savings are being used to cover payroll increases as a result of minimum wage hikes, rent and utility increases, increases in cost of merchandise, and much more.

“They charge 3.99% to my customers so I don’t have to pay anything. If a customer purchases $10 worth of goods, I receive $10. This is one amazing service and it’s completely free for merchants!”

“Thanks to Vader Business. I’m able to manage higher minimum wage laws for my employees without having to reduce their hours or downsize my staff.”